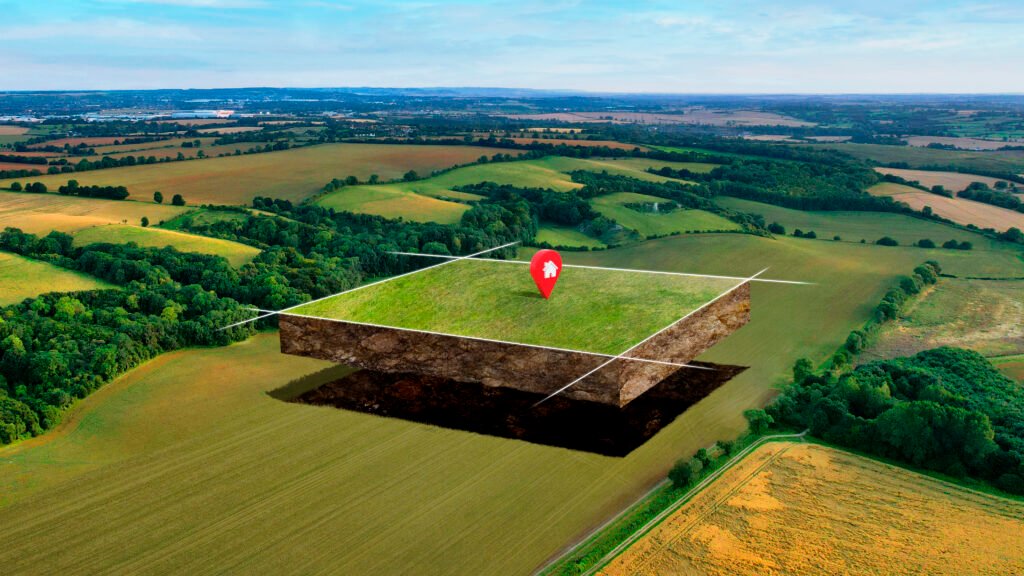

Investing in open plots in Hyderabad this year of 2025 presents an opportunity that thoughtful buyers simply cannot ignore. Land in emerging suburbs offers a rare chance to benefit from today’s prices while holding the key to substantial future gains. When you buy now, you lock in lower costs.

Over the next ten years, as infrastructure develops and demand grows, your investment is positioned to thrive. In this guide, we’ll explain why purchasing open plots makes sense, how a 3000 sq yard investment can save you Rs 3 lakhs per month, and why holding on for a decade amplifies your returns—all while highlighting RR Infra as the trusted partner to help you navigate your real estate journey.

Location and Timing: Laying the Foundation for Real Estate Returns

In recent years, Hyderabad’s city limits have gracefully spilled into suburbs. These locations are now attractive to buy open plots in Hyderabad trend. 2025 marks a pivotal moment: plot prices remain relatively modest before rising quickly in response to new road networks, metro extensions, and commercial developments that follow urban expansion. Buying now means you’re placing your stake at an entry point that promises growth, even though infrastructure upgrades may still be months or years away.

The 3000 Sq Yard Example: Saving and Earnings in One Move

Let’s explore a real-life scenario. You purchase a 3000 sq yard open plot today at a baseline price. If projections are correct and prices climb by Rs 100 per sq yard, your investment instantly translates into a saving of Rs 3 lakhs relative to future costs, purely on paper. That saved amount isn’t a one-time gain; spread over the next ten years, and it symbolizes financial leverage you wouldn’t achieve through rental yield or short-term flips. These plotted investments, unlike apartments, don’t accrue maintenance bills or require immediate building costs, which means all these savings compound in your favor.

EMI Savings and Strategic Delay in Building

When you avoid instant construction, you also delay the need for a high-value home loan. Choosing to wait means you may take a smaller loan later, typically under more favorable economic conditions. As interest rates fluctuate, borrowing wisely becomes possible. The funds you save now may even cover the interest portion of loans taken later. So instead of being squeezed by monthly EMIs, your plot investment holds steady until you’re ready to build, ensuring financial flexibility and reduced burden.

Why Holding for a Decade Is a Smart Strategy

Real estate often rewards patience. Over ten years, Hyderabad’s open plots have historically appreciated many times over, especially when they’re along future infrastructure corridors. These plots typically serve as catalysts for community growth, bringing schools, hospitals, shopping centers, and entertainment options. The long-term hold allows your land to benefit from both planned developments and organic neighborhood expansion. As infrastructure arrives, your investment shifts from a plot of land to a foundation for a lifestyle—whether you choose to develop it or sell at a premium.

Holding for a strategic ten-year period also unlocks tax advantages in India, classifying your gains as long-term capital appreciation and reducing your tax liability upon eventual sale.

Lifestyle Flexibility: Build When You’re Ready

One of the best features of owning an open plot is flexibility. You have the freedom to build a custom home that matches your lifestyle. Unlike pre-built homes that lock you into design constraints, a plot allows you to time construction based on your finances and family timelines. Should your priorities shift over the decade, you could even sell part of the land, use it as collateral, or gift it to family—all with minimal hassle.

Choosing Land vs Other Asset Classes

Far from being a gamble, land is a clean and simple asset. Once you hold the title, it doesn’t require paint, repairs, association fees, or constant upkeep. This sets open plots apart from apartments, commercial spaces, or agricultural land. They’re free from tenant issues or lease terms and offer straightforward legal ownership. In India, owning your land represents security—empowering you to shape your future on your own terms.

Who Should Consider Investing in Open Plots Now

A buy open plots in Hyderabad strategy may be ideal if you’re financially stable, looking for long-term asset growth, and open to waiting for development. If you’re planning a future home, portfolio diversification, or loans that tie to the property value later, an open plot sets the stage for both gains and flexibility. The ten-year hold isn’t just patience—it’s an active plan to watch your value unfold.

Why 2025 Presents a Rare Entry Moment

2025 combines the best of affordability with timing. Plot rates in the city are still accessible, while infrastructure like the ORR, metro, and commercial growth edge closer. The gap between current prices and what they might reach in five or ten years creates a window to lock in value before it vanishes. Add to this the EMI and tax benefits, and you have a compelling case for buying now—not later.

RR Infra: Your Guide in the Open Plot Journey

When aiming for long-term gains in Hyderabad’s open plot market, choosing the right partner makes all the difference. RR Infra has consistently delivered projects in growth areas with reliable legal frameworks, well-engineered road planning, and future-ready layouts. Their plotted developments are designed to support both plot owners and future builders, offering clear titles, transparency, and timely delivery.

RR Infra understands the psychological and financial timeline of a ten-year hold. They structure their plots to withstand delays, support phased development, and enhance resale value. With city expansion and their anticipation of infrastructure trends, they build not just plots, but partnerships based on longevity, trust, and quality—making them the perfect match for anyone looking to secure a profit and peace of mind.

In 2025, investing in open plots isn’t just smart—it’s an opportunity to shape your future. Choose wisely. Invest today. Watch your money grow over the next ten years, with a partner who’s in it for results that last.